Author's Note: In this article, I discuss why location analytics is going to be a sought-after tool by business leaders and feature an interview with Locale.ai, an upcoming startup in India that provides such solutions to companies.

_______________________________________________________________________

“Everything is related to everything else, but near things are more related than distant things. “ - Waldo Tobler’s First Law of Geography

Tobler’s rule rings truer in India owing to the variations in socio-economic, cultural, and geographic characteristics exhibited even within a state. The population density here (20% of the world’s population residing in 2.4% of the total global land) suggests there are more opportunities for businesses to leverage data on a greater number of customers per sq.km in India than elsewhere. Regarded as cookies for the physical world, location data can offer insights around demographic profiling and spend efficiencies, for instance, analytics around affordability levels of people staying in a particular locality, traffic patterns in a lane, among others. With GPS being the primary source of location data, a significant amount of data is gathered through our country’s smartphone user base currently of 500 million (which is estimated to reach 820 million in the next two years). More so, because we consume the highest amount of mobile data (12 GB/month) in the world even as our broadband usage remains low at 4%. Considering that 80% of all data has a spatial component (but only 7% used for analytics), the potential to leverage location analytics in business decisions is enormous and significantly under-penetrated.

Recent fundraises by Locale.ai, NextBillion.ai, DataSutram reflect that VCs are taking notice of the potential that lies ahead.

What is location intelligence?

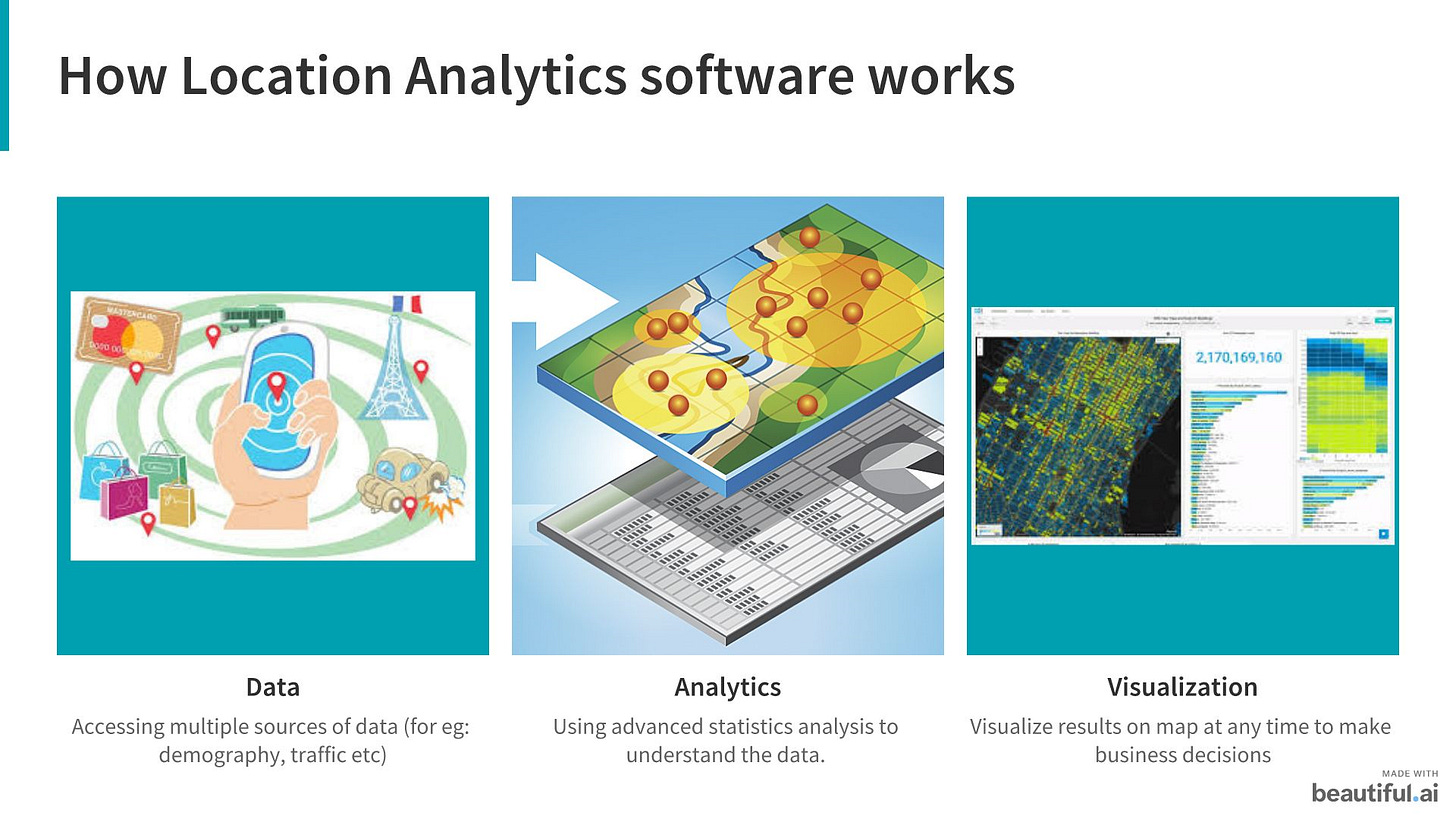

Location data contains information about a specific device’s whereabouts associated to a time identifier, typically in the form of latitude & longitudinal coordinates (lat/long) from a smart device. Location analytics software analyzes this data collected and enables viewing patterns on a map offering insights into the geospatial implications of the data which can be leveraged by decision-makers in companies to optimize business decisions. What differentiates location analytics from Geographical Information Systems (GIS) software is its ability to incorporate real-time big datasets while the latter works largely on historical geospatial data collected. Additionally, the former uses GPS data mostly, while the latter sources data from satellite images, GPS, infra-red sensors, LIDAR, among others.

Where is it already used?

Globally, Uber is one of the most popular examples of using location intelligence to predict traffic patterns, estimate wait-times, suggest the fastest possible route to destinations, or to come up with surge pricing in high-demand areas. Doordash, an on-demand food delivery company leverages location data collected on average parking time, average delivery time in a particular region, and the average time taken at a store for seamless vehicle routing between restaurant to customer’s location. Russian retailer X5 utilized location intelligence software to understand demographics profile in a locality and to estimate potential revenues/profits from opening a store in that area to make data-driven decisions around opening its stores.

Closer home, real estate tech firms like NoBroker.com are using location intelligence to forecast property rent, estimate commute times for passengers, lifestyle scores, etc. With the help of Locus.sh’s software, BigBasket has been able to ensure efficient deliveries to customers in-time and increase its own vehicle utilization that has helped it to reduce freight costs.

What’s the case for location analytics software?

As beautifully articulated by John Luttig in his blog article (few quotes from his article below), startups in recent years have been solving problems with greater operational complexity and often involving more of atoms component, as compared to companies set up during the dotcom era. India’s unicorn list reflects this trend as well with location playing a key role in the operations of 6 out of the top 10 unicorns (Oyo Rooms, Ola Cabs, Swiggy, Zomato, BigBasket & Udaan).

“As the Internet growth tailwinds subside, what’s left? Harder problems. Today, startups tend to focus on problem spaces where there is higher operational and go-to-market complexity. “

The trend above has accelerated a shift in a higher spend on SG&A, relative to R&D, for startups.

“Unlike the organic pull that drove many of the dotcom-era successes, today’s Internet startups need to fight for growth by investing more heavily into sales, marketing, and operations.

In the immature Internet era, a consumer Internet company would likely invest this money into R&D by hiring engineers, product managers, or designers. Consumer Internet companies famously grew without needing employees – Instagram grew to 30 million users with 13 employees in 15 months, and Whatsapp had 500 million users with 50 employees just 5 years after founding. They hired people to support their growing user base after achieving scale.

The dominant startups today tell a different story. As a marketplace with a physical component – say, food delivery or ridesharing – you might spend this money on local ops and supply acquisition. “

Case in point, Uber spent ~41% of its revenues in operations & marketing expenses in 2018 compared to ~13% in R&D, prior to its year of IPO. In contrast, corresponding figures for Facebook were 20% and 10%, respectively, prior to its year of IPO. Indian startups like Swiggy too spent heavily in marketing & delivery which constituted 2x of its revenues in FY19.

“Relative to the R&D-driven growth of early Internet companies, SG&A will become the primary growth vector in the 2020s.

In the past five years, startup spend ROI has become more predictable as it shifts from R&D to SG&A: in contrast to an engineer, a salesperson or operations leader can drive a quantifiable amount of value to your top line (growing revenue) or bottom line (increasing LTV). This creates an increasing need for software to operationalize growth. As growth becomes the key bottleneck of Silicon Valley Internet companies, software that measures and unlocks growth will become correspondingly desirable. “

Salespeople or operation leaders entrusted with the responsibility of driving the topline growth, need to be empowered with sufficient analytical tools in real-time in order to make key decisions in a dynamically changing world. In order to expand the customer base beyond the top cities in India, companies might utilize demographic or geo-behavioral profiling for targeted marketing & launch within the hyperlocal markets of the country. This article from Blume Ventures is a fantastic one on how Dunzo studied the distinct physical and socio-economic characteristics of the micro markets within India to go about its expansion. Demand-based variable pricing or understanding the value add of the product in a given region could be another way to leverage location intelligence to increase revenues. For instance, the value add to a customer from a Zomato Gold membership in the cities of Bangalore or Mumbai with a greater restaurant density could be higher as compared to the value in smaller towns and hence variable pricing could be a great way to increase subscribers. Despite nailing the product-market fit, off-pricing could result in the companies losing out, on potential customers. For organizations solving problems with physical components, Location Analytics software could become the sought-after tool by CXOs.

“Tapering tailwinds mean that incremental spend will slow. This empowers Internet incumbents to capture the remaining incremental spend with their existing product and go-to-market organizations, leaving Internet startups with fewer shots on goal to capture spend.”

While topline growth at all costs was the mantra followed by tech startups prior to 2019, the IPO flameouts of Uber, Lyft, the failed IPO plan of WeWork, and Covid-19 has shifted the focus towards the path to profitability and unit economics for startups and their investors. As funding dries up and private market investors becoming more cautious, early-stage startups are more under pressure than before to grow sustainably. Instead of hiring too many too soon and burning cash in the wrong markets before ultimately winding up, startups would do well to gain insights early-on about their ideal target markets, supply-demand gaps, reasons behind user churn and cancellations, so on and so forth. These details would help companies target their customers better and bring about greater spend efficiencies in marketing & SG&A.

Company Focus: Locale.ai

Co-founders: Aditi Sinha: (Twitter; LinkedIn); Rishabh Jain: (Twitter; LinkedIn)

Locale.ai provides location analytics (particularly, movement analytics) to companies across mobility, on-demand delivery, logistics & supply chain, and workforce.

“There is no 'mobility' without a dynamic location. In other words, location is a fundamental aspect of the movement of assets (people, vehicles, cargo, parcel) on the ground. However, analyzing how assets move across space and time is different from analyzing static points on a map. After all, cities and towns are dynamic, where environments change every square mile. As a result, it is important to add the 'location points' of those areas to contextualize your strategies.” - Locale.ai

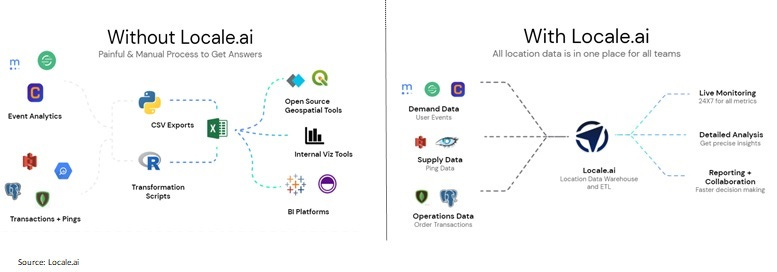

The duo found that business leaders often lacked resources to make real-time decisions on their on-ground operations as getting answers to their questions meant engineers spending days/weeks to create dashboards that were not even scalable. Locale.ai offers insights to senior leaders in real-time without having to write a few lines of code/queries and thus saving time of the clients’ data science professionals to focus on the core product.

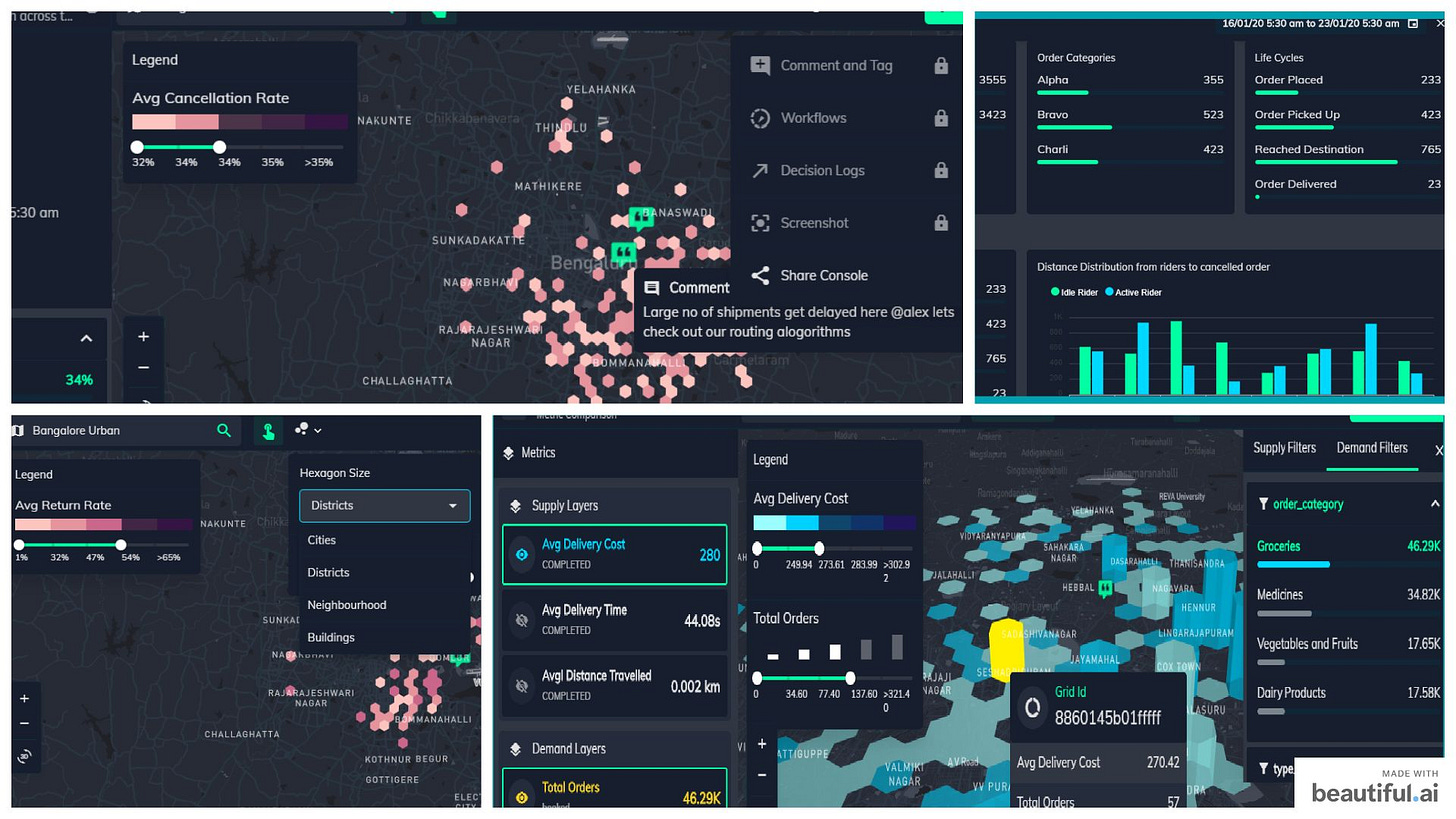

Use cases: Some use cases of the company’s software involve understanding order patterns of clusters for targeted marketing & launch, analyzing booking fulfillment patterns and asset utilization rates, bridging the supply-demand gap, identifying areas for achieving cost efficiencies, creating location profiles, logistics planning & inventory management, monitoring anomalies & intervening in real-time.

Tool: The tool provides a company-wide location dashboard with all metrics, dashboards, insights, and decisions across teams in one place. The team is also working on building an external data-marketplace that allows companies to gain insights over and above the internal data they already have. Additional features include notification alerts, sharing/commenting for discussions, etc.

Personally, I loved the UI and the content strategy followed by the team with the company website hosting exhaustive content in terms of use cases in different industries, a whitepaper, product demo, and their readily available answers (on the blog) to some of the top-of-mind questions like why zip codes might not be the best source for hyperlocal market analysis, value proposition of Locale.ai’s tool over Uber’s open source tool - Kepler.gl and a geospatial expert explaining the need for location analytics for businesses.

I reached out to the team to learn more about their software and business model.

Q: What is the workflow around ingesting data and seeing visualizations?

Ans: Currently, the client needs to get in touch with our sales team on the process of ingesting data into the software. We plan to release a self-serve tool soon for customers to ingest all the location data their company collects across different databases, formats, and systems and then use it to analyze data without writing a single line of code.

Q: Before I read about your company, I was under the impression that mobility tech companies in India would have already built a location analytics tool for themselves - what were your findings from the research you guys did on this space?

Ans: We do get this question on build vs buy choice, a lot. Building geospatial teams within a company often involve hiring data scientists and visualization experts. When companies build internal tools, they often, 1) require queries to be written 2) are not scalable in terms of infrastructure or problems that need to be solved. For instance, an internal tool that is built for analyzing customer profiles might not help in understanding fleet utilization trends. Our software provides analysis across various use cases, metrics, and helps companies save workforce costs on scarce data science professionals.

Q: Any use cases of non-tech, traditional companies that you have worked with/pitched to? Any other interesting use cases that you would like to highlight?

Ans: Most logistics firms here are still grappling with legacy tools, we have worked with them to interpret patterns in reverse logistics, route optimization, and gain better insights into their fleets’ idle time. We also help companies analyze data on their fixed assets, in terms of warehouse management (eg: which warehouses are taking a longer time to package or deliver goods, etc). Retailers could also leverage our tool to make decisions around the locations of their warehouses/dark stores. We are also experimenting with solutions for companies being able to map home address considering the unstructured nature of Indian addresses.

Apart from mobility data, we can also analyze geospatial data. We worked with a research group (AI on the beach) to examine the movement of sharks in an ocean that could be impacted by shipping vessels. Recently, we were approached by a fintech company to create user profiles for targeting insurance products, to track the number of customers a sales rep is able to visit, etc.

Q: Could you elaborate more on your partnership with Irys? For companies that don’t have a presence in a market yet (and hence no data of its own), would Locale.ai be able to provide solution wrt market selection?

Ans: Irys collects GPS data reflecting movements of people around the city and we analyzed this data to gain insights on mobility pre & post lockdown in March. Companies could have leveraged this data to strategize their delivery personnel allocation during the lockdown. We do plan to overlay an external data marketplace on the top of a company’s internal data, in the longer term. So, this feature could also help leverage companies analyze various parameters such as affluence, traffic, mobility, in markets where they don’t have a presence yet, for their market research on launch strategy.

Q: How does your business model/pricing work?

Ans: We are still experimenting with prices; currently it is based on the scale of the business, amount of data to ingest (in terms of the number of records, number of user profiles, number of tools to connect, etc). SMBs with operations in just 1 city could be charged at least $200/month while for companies with more than 1 million orders/month, the fee could be at least $1,000/month.

Q: What proportion of your business comes from India vs. international?

Ans: So far, we have had equal exposure to India and international, the goal is to ramp up presence internationally (more towards the US). In India, we have worked with micro-mobility companies, logistics companies, and courier services as well. Internationally, we have worked with a Shopify merchant to help them gain more insights around their shipping costs.

Q: Are there any technical challenges in working on location data in India as compared to other countries?

Ans: Geography variations don’t pose a challenge in location analytics; storing & processing different types of data pose the main challenge, especially when clients have data that cannot be easily ingested into our tool.

Q: What are your future plans for Locale.ai?

Ans: We aim to scale in other markets, gain more visibility & increase the number of use cases for financial services, retailers, etc. Longer-term, we would love to see applications of our tool in social and governance matters such as tracking missing children, city planning, among others.

—————————————————————————————————————-

Pasted below are some snaps from the demo of Locale.ai tool:

Appendix:

Some links on/from the company:

Podcast with Crosstalk conversations on founder background, journey so far & future plans.

Interview with Inc42 on software, pricing & competitors